Introduction:

Taxes have been a part of the American experience since the country’s inception. From the colonial era to the present day, taxation has played a significant role in shaping the nation’s fiscal policy and economic growth. In this blog post, we’ll take a brief look at the major milestones in the tax history of the United States.

The Colonial Era (1690s-1776):

During the colonial period, taxes were imposed by the British government to fund various expenses, including the maintenance of the colonies and military defense. The Stamp Act of 1765 was a major tax that sparked outrage among colonists, who argued that only their own legislatures had the right to impose taxes. This led to protests and boycotts, ultimately contributing to the outbreak of the American Revolution.

The Revolutionary Era (1776-1789):

After declaring independence from Britain, the newly formed United States faced the challenge of funding its government and military efforts. In 1777, the Continental Congress enacted the first direct tax, the Continental Tax, to fund the war effort. However, it was not until the Articles of Confederation were replaced by the Constitution in 1789 that a more stable tax system was established.

The Early Republic (1789-1860):

Under the new Constitution, the federal government was granted the power to impose taxes to fund its operations. The first federal tax was the Tariff Act of 1789, which aimed to protect American industries by imposing taxes on imported goods. Over the next several decades, the federal government continued to rely on tariffs and excise taxes to fund its activities, while state governments imposed taxes on property, sales, and other activities.

The Civil War Era (1860-1877):

The American Civil War saw a significant increase in federal taxation, as the government needed to fund its military efforts and pay for the reconstruction of the South. The Revenue Act of 1861 introduced a new income tax, while the Excise Tax Act of 1862 imposed taxes on various products, including whiskey, tobacco, and beer. These taxes helped to finance the war and eventually led to the abolition of slavery.

The Progressive Era (1877-1920):

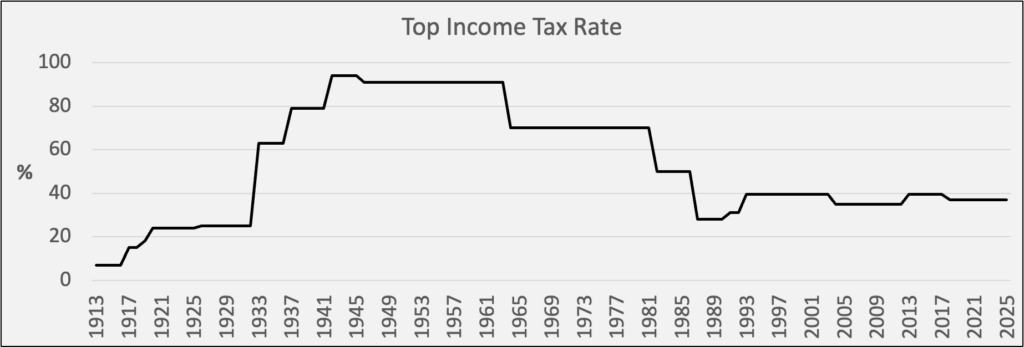

During the late 19th and early 20th centuries, the federal government began to expand its role in regulating the economy and providing social services. This led to an increase in federal taxation, including the introduction of the income tax amendment to the Constitution in 1913. The 16th Amendment allowed for a progressive income tax, with higher rates applied to higher earners.

World War II and the Postwar Era (1920-1980):

The outbreak of World War II saw a significant increase in federal taxation, as the government needed to fund its military efforts and pay for the war effort. The Revenue Act of 1942 introduced a new payroll tax to fund Social Security, while the top income tax rate reached 94% in 1945. After the war, the federal government continued to rely on income taxes, payroll taxes, and excise taxes to fund its activities.

The Modern Era (1980-Present):

In recent decades, the federal government has continued to rely on a combination of income taxes, payroll taxes, and excise taxes to fund its activities. However, the Tax Reform Act of 1986 and the Tax Cuts and Jobs Act of 2017 have significantly altered the tax landscape, with the former reducing tax rates and the latter lowering corporate taxes and increasing the standard deduction.

Conclusion:

From the colonial era to the present day, taxation has played a vital role in shaping the nation’s fiscal policy and economic growth. As the United States continues to evolve, it is likely that the tax system will undergo further changes to meet the challenges of the 21st century.